AI Solutions for Streamlining Financial Services with Intelligent Document Processing

Posted on : October 28th 2024

Intelligent Document Processing (IDP) combines Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) to automate the extraction and processing of unstructured data from physical and digital documents.

The increasing volume of semi-structured and unstructured documents poses significant challenges in efficiently capturing, analyzing, and processing data. These tasks often become error-prone and time-consuming.

IDP’s Advantages

IDP offers faster, more accurate document processing, helping businesses streamline data acquisition while extracting valuable insights. It allows organizations to transform unstructured data from various document formats into high-quality, structured data at scale.

Financial services companies continuously grapple with tedious and mundane repetitive tasks such as transferring data between systems. Freeing employees for more valuable work is difficult in such circumstances.

Traditional automation solutions often fail to handle unstructured data efficiently, which impacts critical workflows like insurance claims processing or KYC checks. IDP bridges this gap by using AI and cognitive skills to process unstructured content efficiently and accurately.

By unlocking insights from previously inaccessible data, IDP transforms challenges into opportunities.

AI-powered IDP for End-to-end Automation

Integrating IDP with AI-powered automation enables organizations to fully automate end-to-end processes, going beyond basic document management.

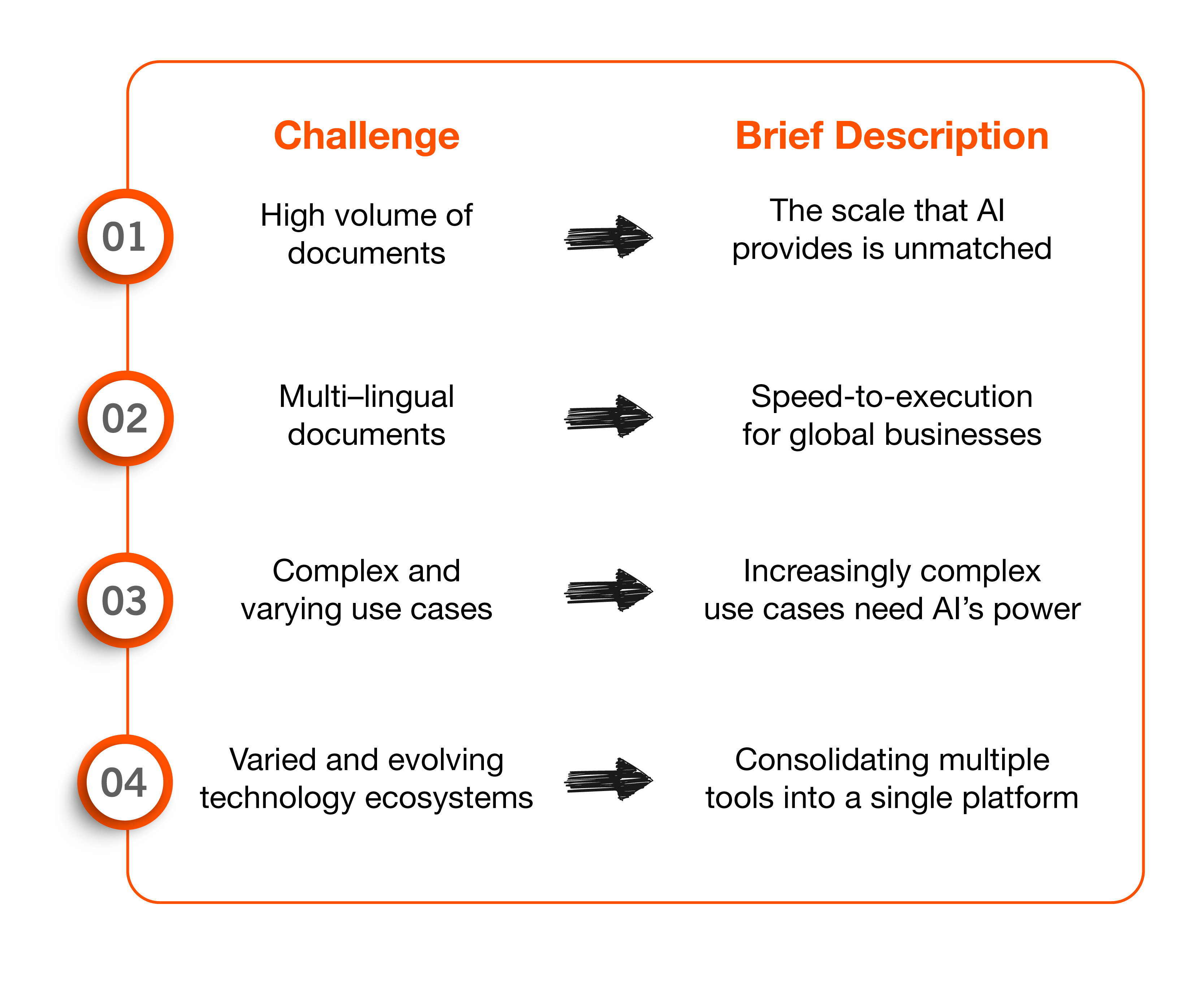

By incorporating IDP into an AI-powered automation platform allows firms to extract critical insights from documents, enhance client relationships, strengthen compliance, and transform large volumes of unstructured data into actionable intelligence. It solves several pain points or challenges.

Exhibit 1: Common Challenges that AI-powered IDP Overcomes

Financial services companies benefit from AI-powered IDP’s ability to process various types of documents, whether digital files or scanned paper documents, streamlining document workflows with speed and efficiency.

The Power of Customization

Financial services firms are facing increasing pressures to optimize operations, reduce costs, and comply with complex regulatory requirements. Simple automation technologies like RPA often fall short when processing semi-structured and unstructured data. However, AI-powered IDP can extract meaningful data from complex documents and seamlessly integrate with RPA systems, feeding extracted data into downstream applications for further automation.

For example, in loan origination workflows, IDP can classify and validate documents like tax returns and bank statements. Financial institutions handle various documents, including applications, identity proofs, invoices, and contracts. AI-powered custom IDP workflows help scale operations rapidly, supporting 24/7 processing capabilities.

The Role of Quality Data

AI-led IDP adoption requires careful planning and a robust roadmap. Banks and financial institutions must assess the potential of automation, plan strategically, and ensure proper employee training. The quality of training data is crucial for the success of IDP, as well-labeled document sets improve the system’s ability to extract relevant information accurately.

The integration of Generative AI (GenAI) has further accelerated IDP’s evolution. Traditionally, IDP focused on automating repetitive document handling tasks, but GenAI has transformed it into an advanced, end-to-end intelligent automation system capable of handling unstructured data. With GenAI IDP can now manage tasks like multilingual document processing, content summarization, and accurate data validation with unprecedented speed and accuracy.

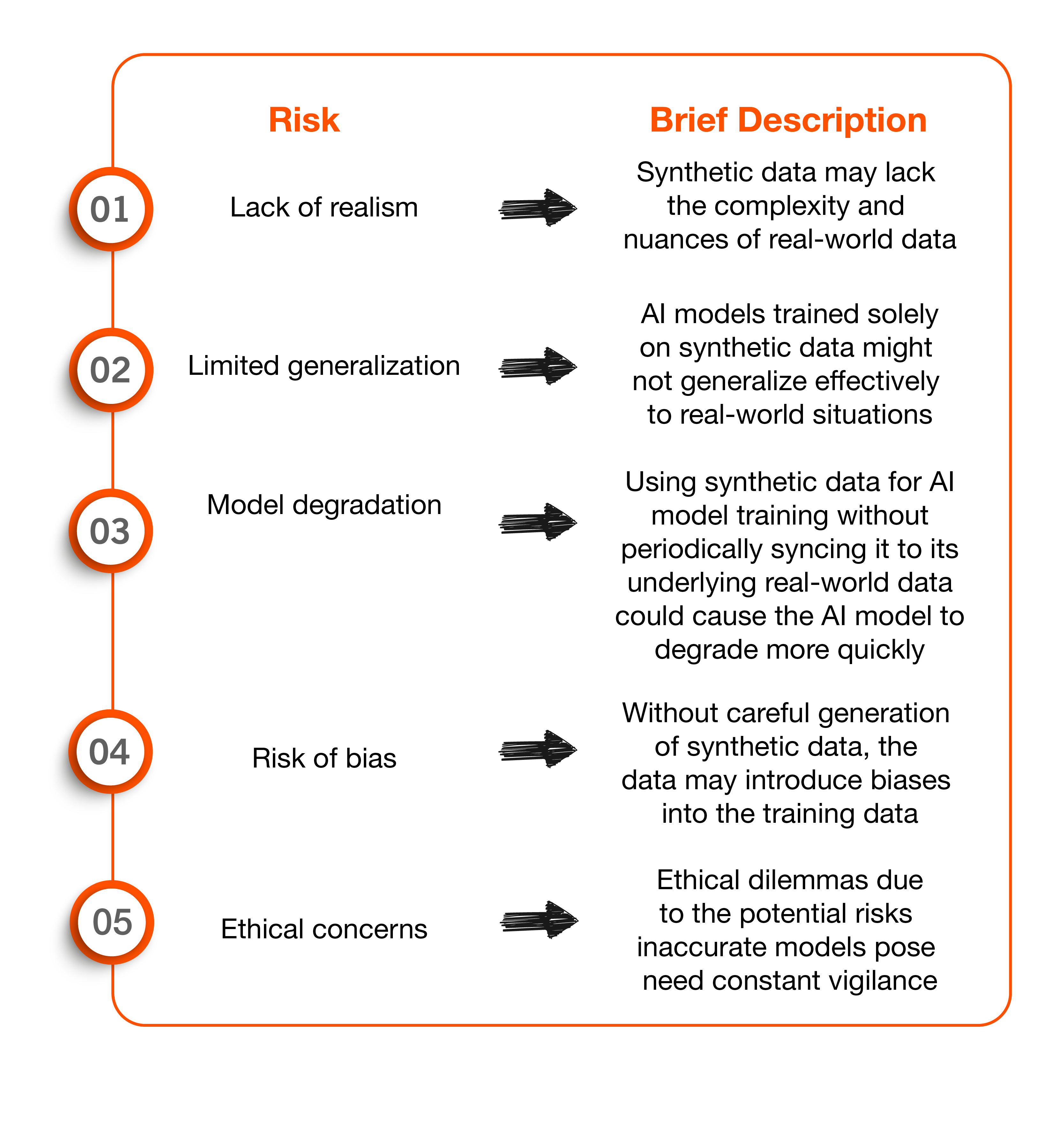

A breakthrough introduced by GenAI is the ability to generate synthetic training data for model training. However, it is essential to approach this responsibly and remain mindful of the risks involved.

Exhibit 2: Risks to be Mindful of while Using Synthetic Data

Setting realistic expectations from the outset helps mitigate risks and avoid potential reputational issues.

Straive Gives the Edge

Straive’s IDP solutions automate complex workflows like contract analysis, invoice processing, and regulatory compliance. By processing unstructured documents, our algorithms accelerate decision-making and ensure scalability with precision. With a dedicated R&D unit, Straive focuses on innovation and customization, driving high-value business outcomes through precise automation.

About the Author

Sudhakaran Jampala is a Content Writer (Marketing) with Straive, specializing in the cutting-edge technology areas of data science, machine learning, and AI. He is fascinated by the art of storytelling, which transforms data into sparkling insights by revealing patterns and infusing visual narratives.

We want to hear from you

Leave a Message

Our solutioning team is eager to know about your

challenge and how we can help.